Having an exceptional insurance website design isn’t just nice to have – it’s essential for customer acquisition and business growth.

The best insurance websites of 2026 go far beyond listing coverage options and contact information. They create immediate trust, simplify complex insurance concepts, make quote generation effortless and demonstrate the modern, customer-first approach that sets them apart from traditional carriers. Whether you’re an independent agent looking to redesign your outdated site or an established carrier seeking insurance web design inspiration, these 10 companies demonstrate what top-tier insurance website design looks like in 2026.

What Makes an Insurance Website Design Stand Out?

Before exploring our featured companies, let’s examine what separates exceptional insurance websites from mediocre ones. The most effective insurance website designs share critical characteristics:

- Clean, modern aesthetics that build instant credibility rather than looking dated.

- Intuitive navigation that helps visitors find information in seconds.

- Mobile-responsive design that delivers flawless experiences on smartphones and tablets.

- Prominent quote generators and calls-to-action that guide visitors toward conversion.

- Authentic imagery showcasing real people and scenarios.

- Educational content that positions your company as a trusted authority.

- Trust signals like customer testimonials, financial strength ratings and transparent pricing.

Today’s insurance customers expect convenience and transparency. They want instant quotes without phone calls, clear information about coverage options, easy-to-understand policy comparisons, mobile apps for policy management and answers to common questions through self-service resources. The insurance web design examples below understand these modern expectations and have created digital experiences that convert website visitors into policyholders while supporting sustainable business growth.

Top Insurance Website Rankings:

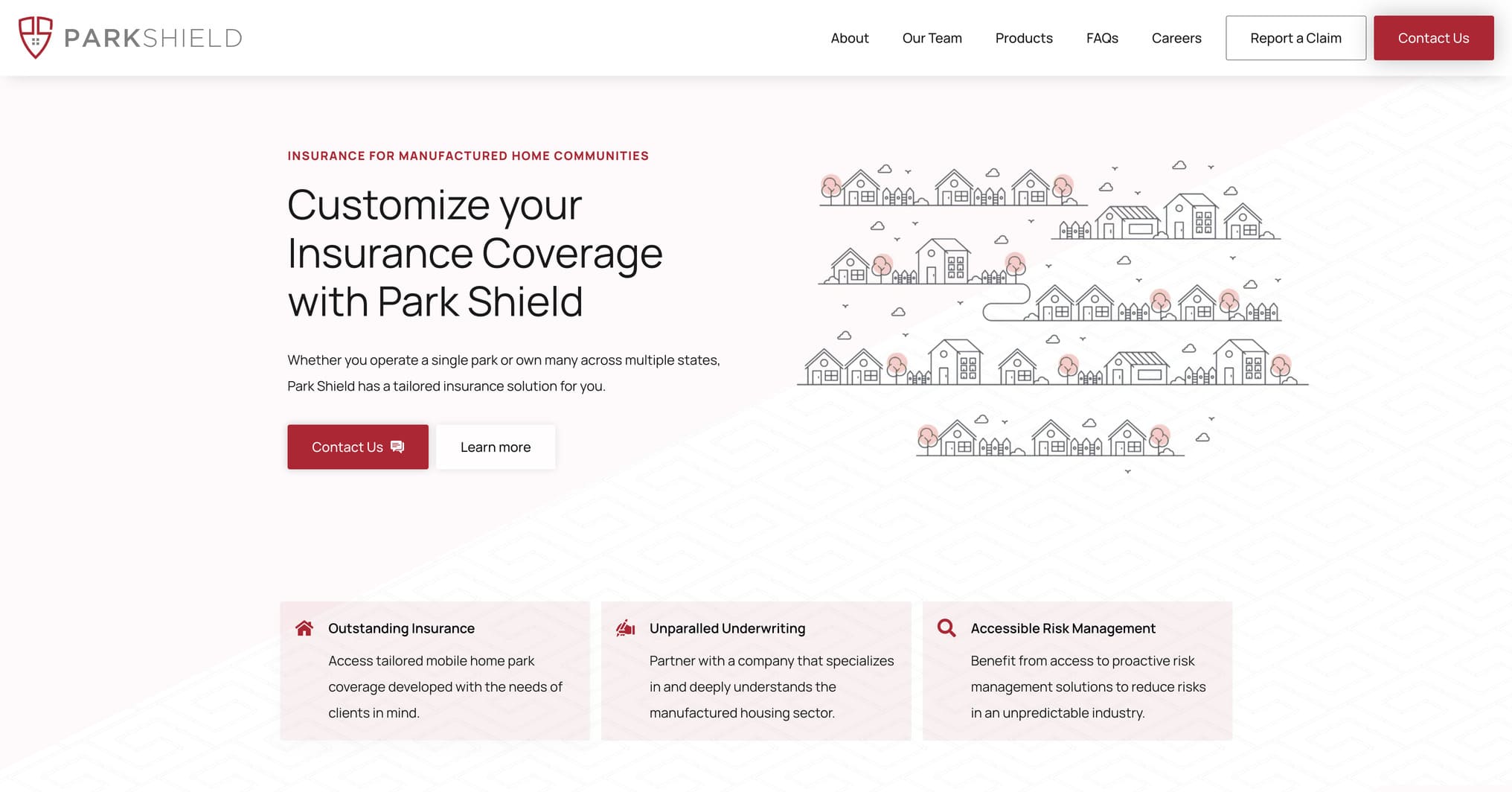

1. Park Shield

Website: https://parkshieldins.com/

Company Overview: Park Shield is a specialized insurance company that provides comprehensive property and liability coverage exclusively for manufactured home communities across the United States. Operating under BlueSkyRisk, Park Shield works with the nation’s top agents and brokers to deliver tailored insurance solutions for owners of single parks or multi-state portfolios, with property coverage limits up to $10M+ and liability protection up to $4M through policies underwritten by A- rated carriers. This website was designed and developed by Azuro Digital – we’re an industry-leading insurance web design agency.

Why Their Website Design is Top Tier:

- Niche-Focused Visual Identity: The homepage features custom illustrations of manufactured housing communities rather than generic insurance imagery, immediately signaling specialization and deep understanding of this specific industry, making park owners feel understood from the first impression.

- Strong Trust Indicators: AM Best A- (Excellent) financial strength ratings are prominently displayed alongside national coverage territory metrics, building immediate credibility for a specialized program that might be unfamiliar to prospects comparing options.

- Smart FAQ Integration: Rather than burying common questions in help documentation, Park Shield surfaces critical details about underwriting carriers, coverage territories and park-owned home eligibility directly on the homepage through an elegant accordion interface that answers objections before prospects even ask.

- Conversion-Optimized Simplicity: The clean layout with strategic whitespace and minimal distractions keeps visitors focused on the core message and clear next steps, reducing decision fatigue.

2. Lemonade

Website: https://www.lemonade.com/

Company Overview: Lemonade is a technology-driven insurance company founded in 2015 that offers renters, homeowners, car, pet and life insurance through a completely digital platform. As the world’s first peer-to-peer insurance carrier, Lemonade uses AI and behavioural economics to deliver instant quotes, seamless claims processing and a unique Giveback program that donates unclaimed premiums to charities chosen by policyholders.

Why Their Website Design is Top Tier:

- Vibrant, Approachable Visual Identity: The bright pink and white colour scheme breaks away from traditional insurance colour palettes, creating an instantly memorable brand that feels fresh, modern and accessible to younger consumers seeking alternatives to legacy carriers.

- AI-Powered Conversational Experience: Rather than traditional forms, visitors interact with Maya, an animated chatbot that makes getting quotes feel like a natural conversation, reducing friction and making insurance feel less intimidating and more human.

- Illustrated Storytelling: Playful, custom illustrations throughout the site explain complex insurance concepts in simple visual terms, making coverage options immediately understandable while maintaining a personality-driven brand voice that sets them apart.

- Social Proof Above the Fold: Customer ratings, press features from major publications and claim processing speed statistics are prominently displayed on the homepage, building instant credibility and addressing common concerns about trusting a digital-first insurance company.

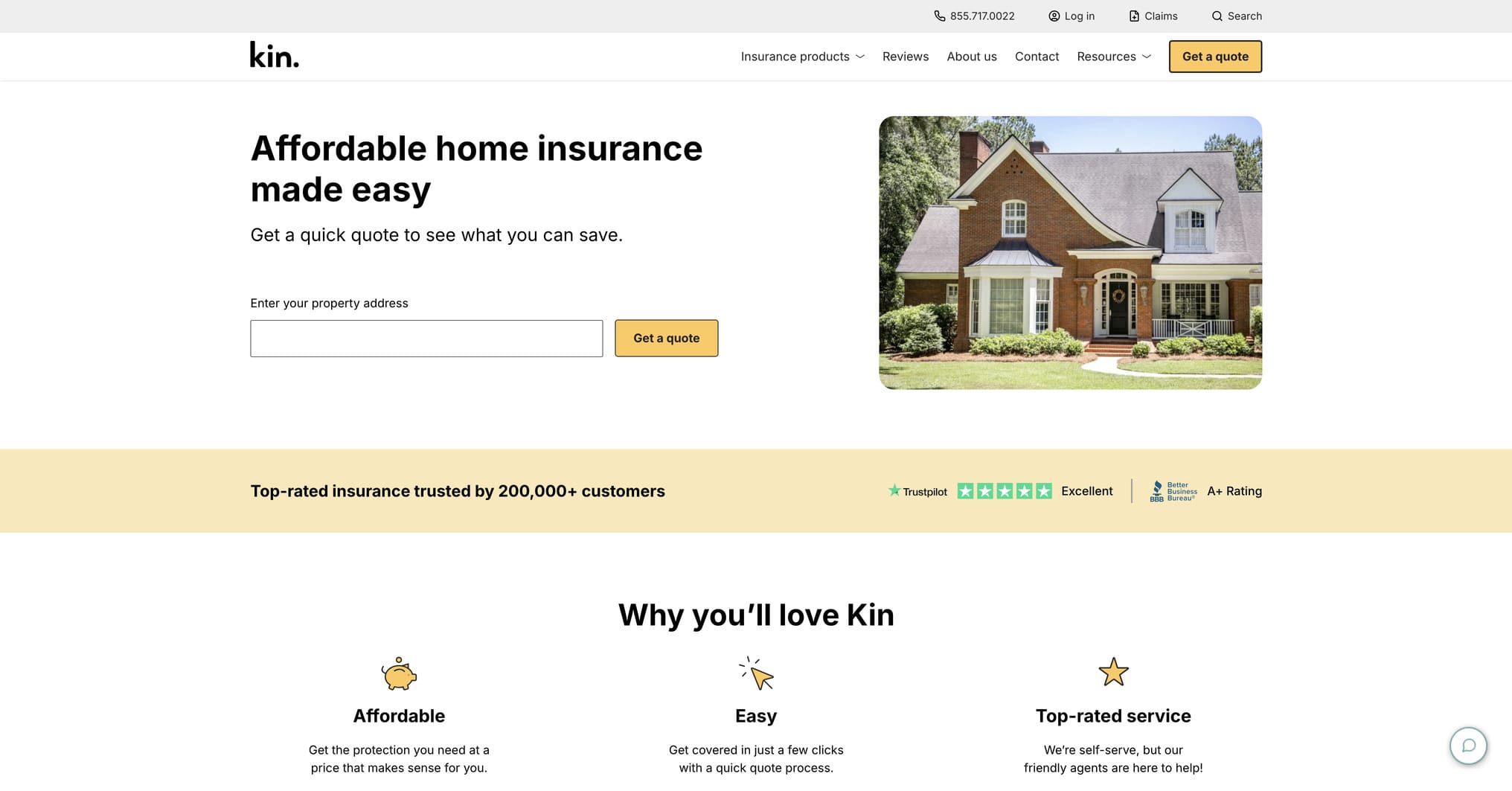

3. Kin Insurance

Website: https://www.kin.com/

Company Overview: Kin Insurance is a direct-to-consumer home insurance company founded in 2016 by seasoned fintech entrepreneurs to fix insurance for catastrophe-prone regions. Licensed as a full-stack carrier, Kin serves coastal homeowners and high-risk areas most impacted by climate change, using proprietary technology to offer coverage that traditional insurers often avoid while keeping premiums affordable.

Why Their Website Design is Top Tier:

- Climate-Forward Messaging: Bold photography of coastal properties and clear messaging about serving areas affected by hurricanes, wildfires and floods positions Kin as the solution for hard-to-insure homes, directly addressing a major pain point traditional carriers ignore.

- Real-Time Quote Technology: The website showcases Kin’s proprietary technology that delivers instant quotes using thousands of data points, with transparency about the rating factors and modern underwriting that makes coverage possible for previously uninsurable homes.

- Customer Experience Focus: Prominent display of 4.5+ star ratings, specific customer testimonials about claim experiences and clear communication about response times demonstrates Kin’s commitment to service in an industry known for disappointing customer experiences.

- Educational Content Library: Comprehensive guides about coastal insurance requirements, hurricane preparation, flood coverage and home protection strategies position Kin as an expert partner rather than just a policy provider, building long-term trust.

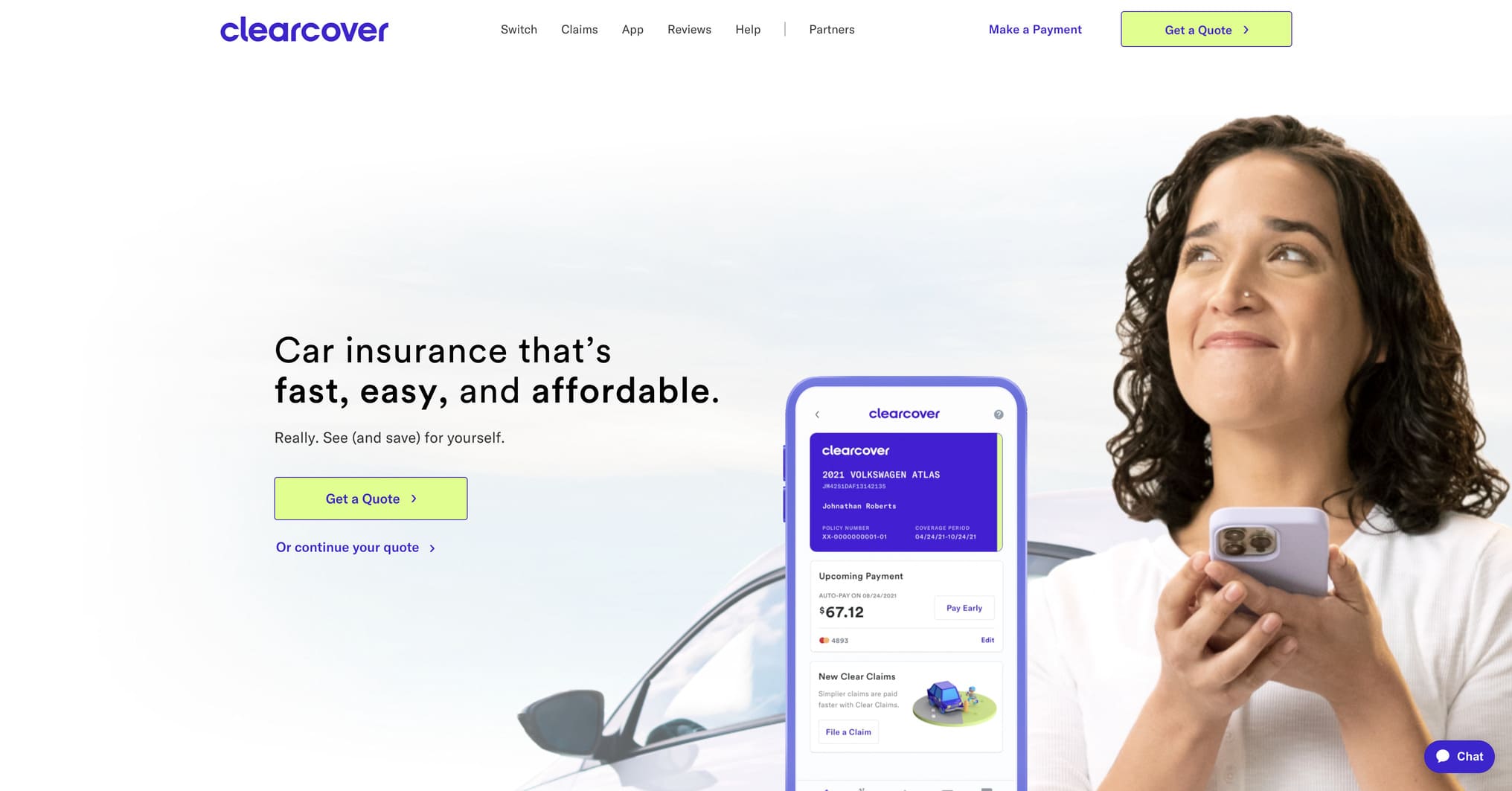

4. Clearcover

Website: https://www.clearcover.com/

Company Overview: Clearcover is a digital-first auto insurance company founded in 2016 that uses technology and data to provide affordable car insurance without the inefficiencies of traditional carriers. Based in Chicago, Clearcover offers fast claims processing powered by AI, with some claims paid in as little as 30 minutes, along with competitive rates and a streamlined digital experience.

Why Their Website Design is Top Tier:

- Speed-Focused Value Proposition: The homepage immediately highlights Clearcover’s fastest claims processing in the industry with concrete examples and customer stories, making the abstract concept of “digital insurance” tangible through real-world time savings.

- Data-Driven Pricing Transparency: Clear explanations of how Clearcover uses technology to eliminate traditional overhead costs and pass savings to customers, with transparent pricing methodology that builds trust through education rather than vague promises of savings.

- Modern Interface Design: Clean typography, unique colour palette, elegant layouts and tasteful motion effects create a contemporary feel that signals innovation and efficiency, appealing to tech-savvy drivers tired of legacy insurance experiences.

- AI Technology Showcase: The website features their proprietary ClearAI technology and how machine learning improves everything from quoting to claims, positioning Clearcover as a true insurtech innovator.

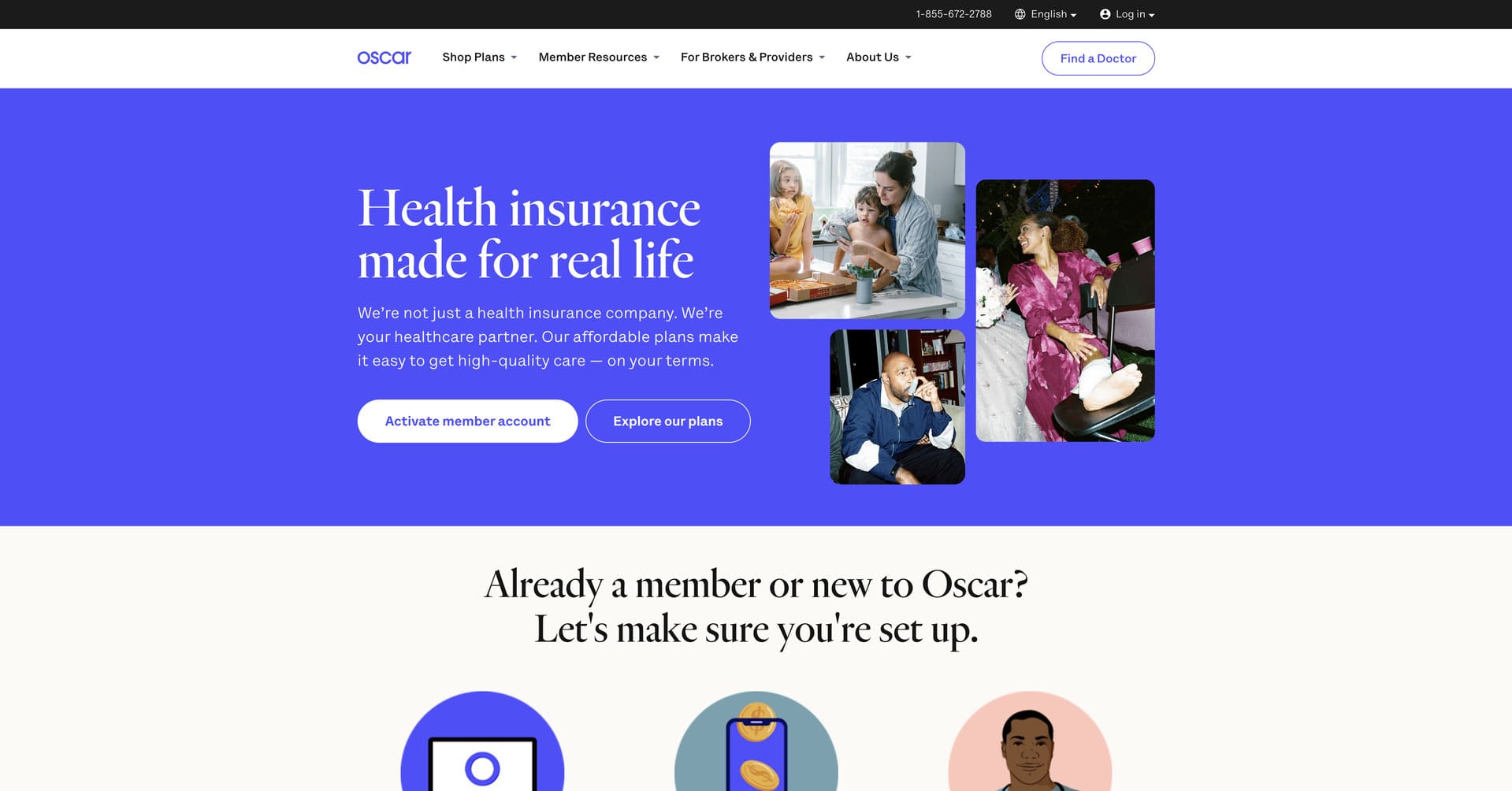

5. Oscar Health

Website: https://www.hioscar.com/

Company Overview: Oscar Health is a technology-driven health insurance company founded in 2012 to make healthcare simple, intuitive and human. Operating across multiple states, Oscar combines comprehensive health coverage with a technology platform that includes telemedicine, personalized care guidance and a mobile app that puts all health needs in one place for individuals, families and small businesses.

Why Their Website Design is Top Tier:

- Clean, Healthcare-Focused Aesthetics: Soft blues and generous white space create a calming, clinical-yet-approachable environment that immediately puts visitors at ease while conveying professionalism and trustworthiness in the complex healthcare space.

- Intelligent Plan Comparison Tools: Interactive tools allow visitors to compare plan options side-by-side with clear visualizations of coverage differences, deductibles and out-of-pocket costs, empowering informed decision-making without overwhelming users with jargon.

- Personalized Member Portal: The design seamlessly transitions between public-facing content and logged-in member experiences, with clear pathways to find doctors, check claims, access virtual care and manage all health needs in one intuitive platform.

- Human-Centred Approach: The site breaks away from sterile healthcare aesthetics with warm photography of real people and families, approachable copy that explains complex health concepts in plain language and a visual hierarchy that prioritizes member needs over corporate messaging, making health insurance feel less intimidating.

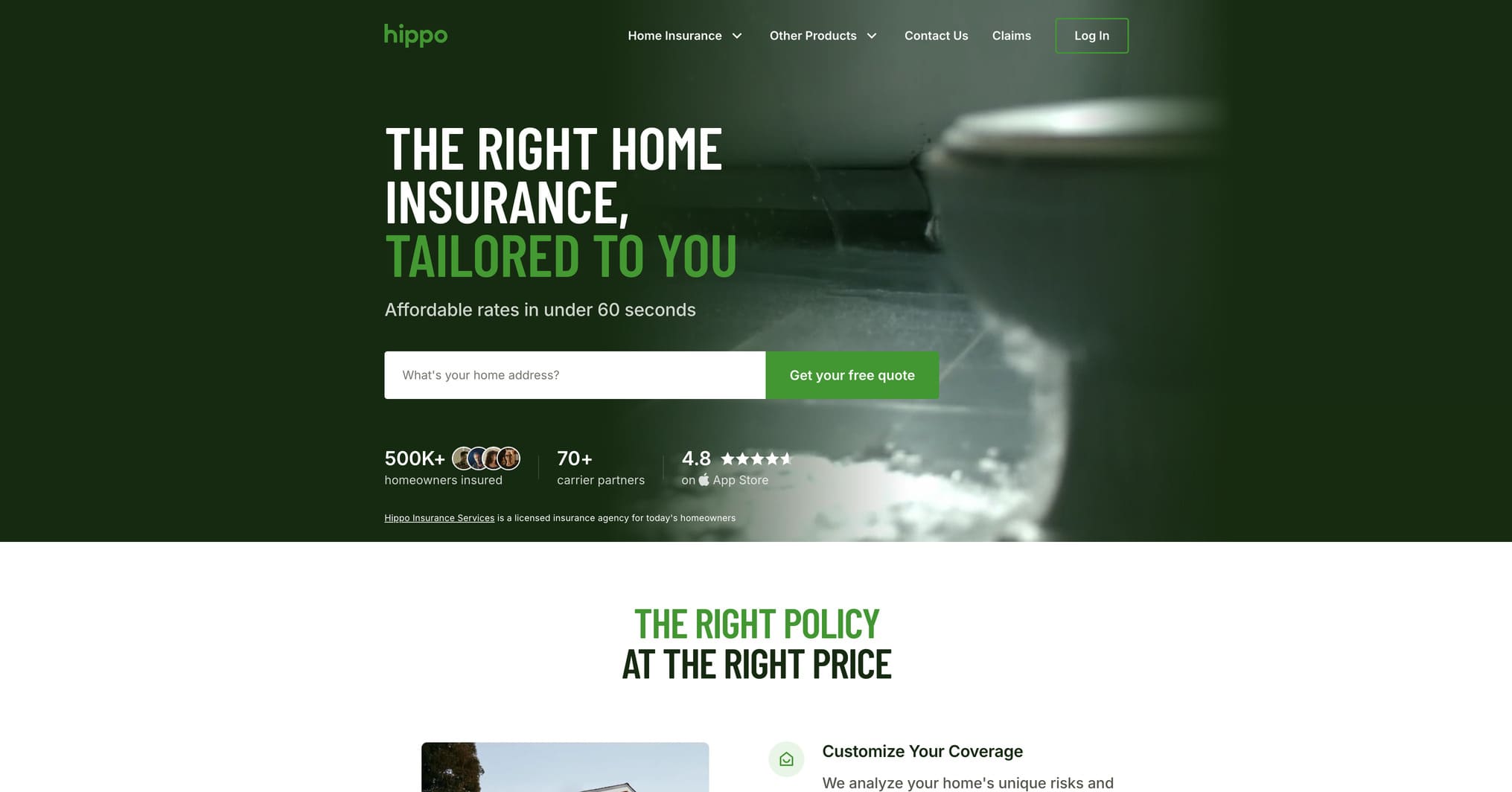

6. Hippo Insurance

Website: https://www.hippo.com/

Company Overview: Hippo Insurance is a home insurance company founded in 2015 that uses modern technology and smart home devices to offer proactive homeowners coverage. Based in Palo Alto, Hippo provides comprehensive protection for over 200,000 homes across 39 states, focusing on preventing claims before they happen through IoT integrations and offering 60% more coverage than standard policies at competitive prices.

Why Their Website Design is Top Tier:

- Smart Home Integration Showcase: The website prominently features Hippo’s free smart home kit with leak, smoke and CO2 sensors, using clean product photography and clear explanations to demonstrate how technology prevents claims rather than just processing them after disasters.

- Transparent Coverage Architecture: Coverage tiers are presented with crystal-clear visual comparisons showing exactly what’s included at each level, removing the mystery from homeowners insurance and making it easy to understand value differences without industry jargon.

- Risk Prevention Positioning: Rather than fear-based messaging common in insurance, Hippo’s design emphasizes empowerment and prevention, with bright, optimistic imagery and copy focused on protecting what matters most through proactive technology.

- Streamlined Quote Experience: The homepage features an incredibly simple quote form requiring just an address to get started, dramatically reducing friction and allowing visitors to see personalized pricing in minutes rather than scheduling phone appointments.

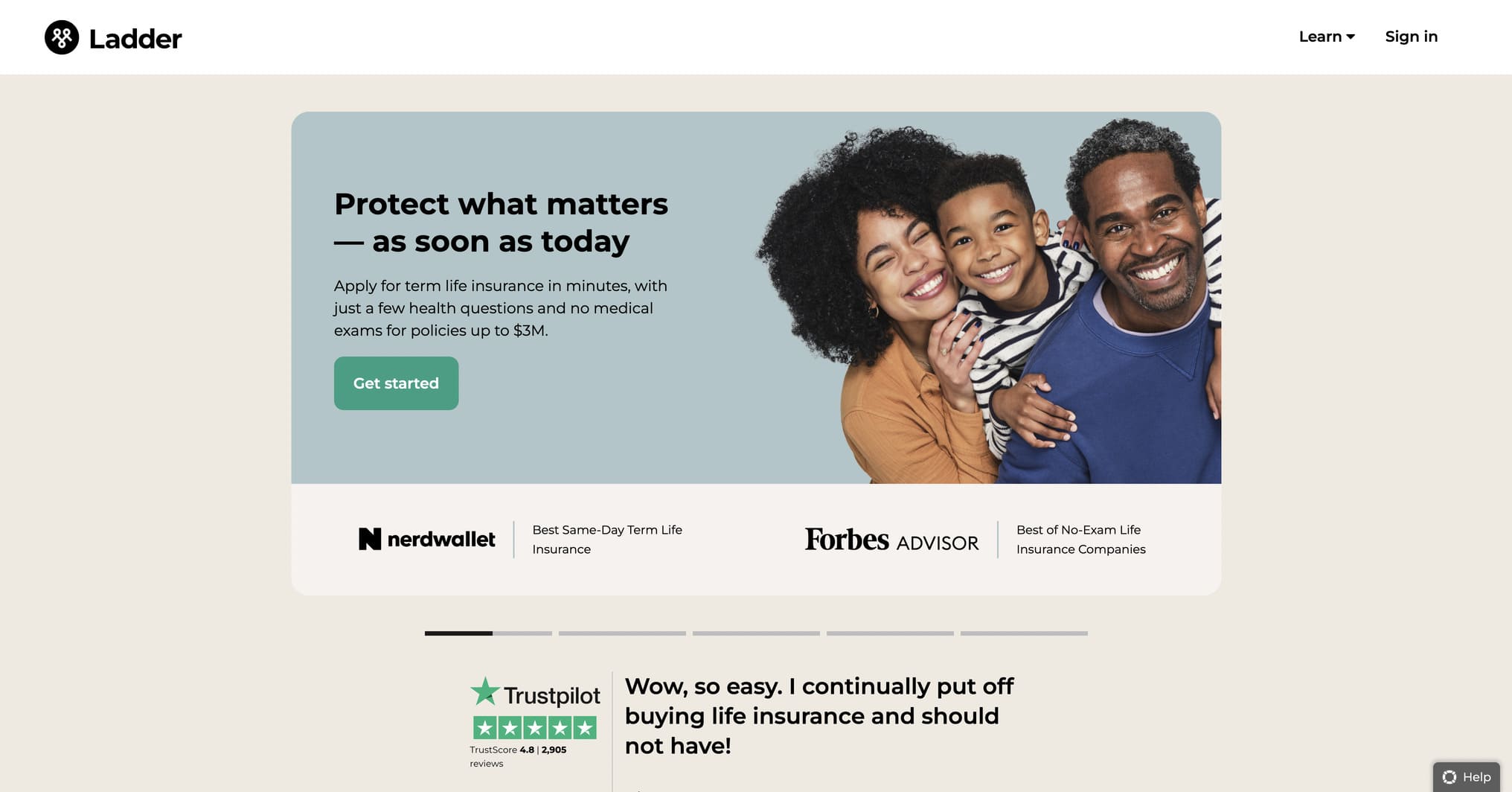

7. Ladder Life Insurance

Website: https://www.ladderlife.com/

Company Overview: Ladder is a digital life insurance company founded in 2015 that offers flexible term life insurance for people ages 20-60. With coverage amounts from $100,000 to $8 million and a unique “Laddering” feature that lets policyholders adjust coverage as life changes, Ladder provides no-medical-exam policies up to $3 million through a completely paperless application process.

Why Their Website Design is Top Tier:

- Minimalist, Trust-Building Design: The restrained colour palette of soft pastels and generous white space creates a calm, confident aesthetic that feels more like a financial planning tool than traditional insurance marketing, positioning Ladder as sophisticated and reliable.

- Transparent Pricing Methodology: The site clearly explains how Ladder calculates premiums and what factors affect pricing, removing mystery from the process and building trust through education.

- Flexible Coverage Visualization: Interactive tools show how coverage needs change over time with clear visualizations of the “Laddering” concept, making it easy to understand how term lengths and coverage amounts can be strategically structured for maximum value.

- Streamlined Digital Experience: The entire application process is beautifully streamlined with progress indicators, minimal form fields and instant feedback, allowing customers to go from quote to coverage in minutes without phone calls or paperwork while maintaining a premium, trustworthy aesthetic throughout.

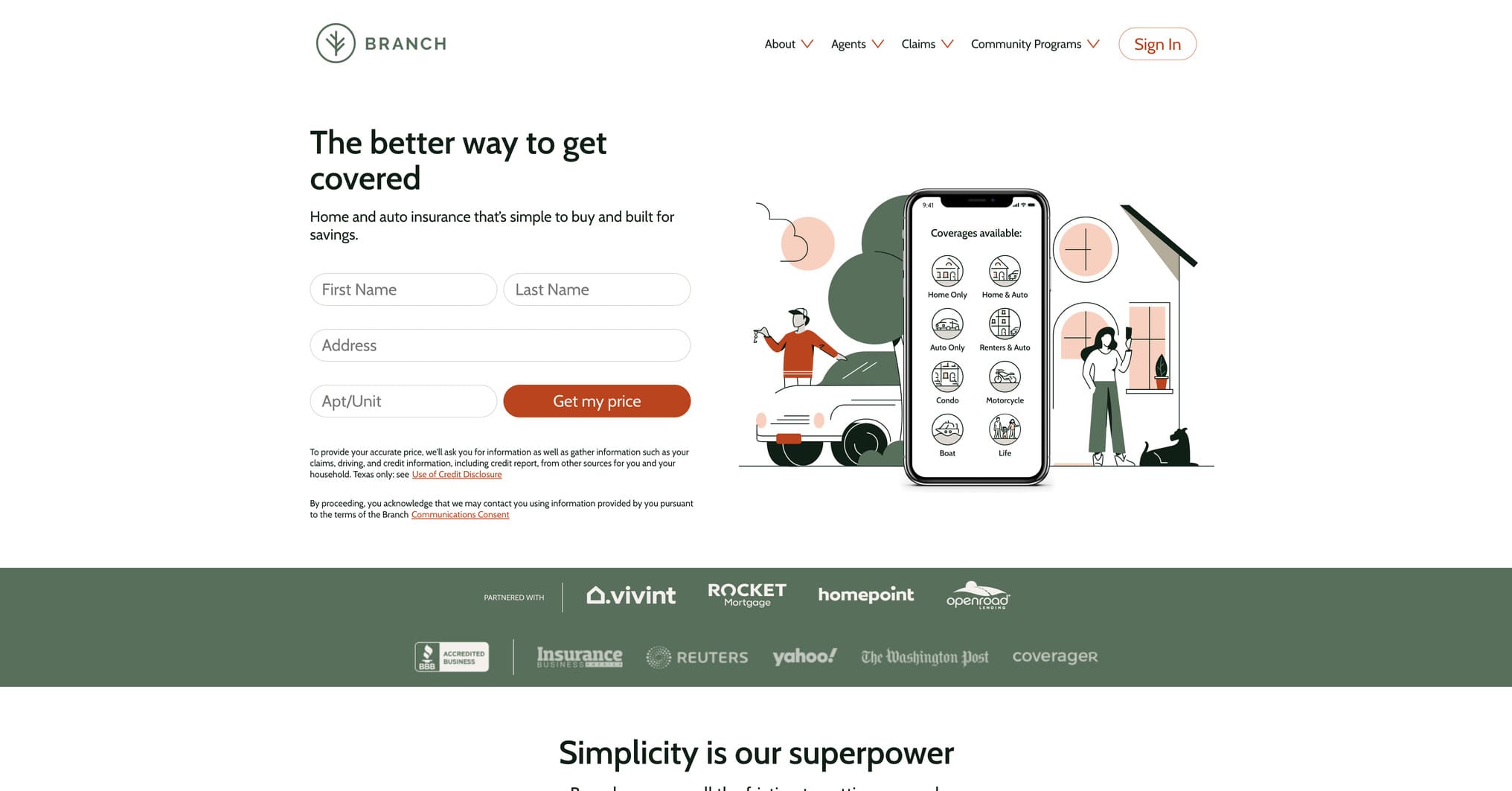

8. Branch Insurance

Website: https://www.ourbranch.com/

Company Overview: Branch Insurance is a mission-driven home and auto insurance company founded in 2017 that operates as a mutual-like structure, allowing policyholders to share in savings through co-ownership. Based in Columbus, Ohio, Branch uses bundling to reduce premiums by an average of 25% while creating a community-focused approach where customers benefit from collective good behaviour.

Why Their Website Design is Top Tier:

- Community-Driven Narrative: The website emphasizes Branch’s unique co-ownership model with clear messaging about how policyholders share in the company’s success, using inclusive language and community-focused imagery that differentiates them from traditional profit-driven carriers.

- Bundling Simplicity: The site makes bundling home and auto insurance incredibly straightforward with visual tools showing exact savings percentages and how combining policies works, removing confusion and making the value proposition immediately clear.

- Transparent Savings Calculator: Interactive tools show exactly how much customers can save through bundling, good driving behaviour and other factors, with honest comparisons to competitors that build trust through transparency rather than vague savings promises.

- Mission-Focused Storytelling: The design weaves Branch’s purpose-driven narrative throughout the user journey with authentic testimonials about community impact, clear explanations of the co-ownership model and visual elements that reinforce how insurance can be a force for good rather than just a necessary expense.

9. Next Insurance

Website: https://www.nextinsurance.com/

Company Overview: Next Insurance is a digital insurance company founded in 2016 that specializes in simple, affordable business insurance for small businesses and independent contractors. Serving over 300,000 customers across industries from general contractors to photographers, Next offers instant online quotes, immediate coverage and policies starting at $13 per month tailored to specific business types.

Why Their Website Design is Top Tier:

- Industry-Specific Landing Pages: Rather than generic business insurance messaging, Next creates dedicated pages for dozens of specific professions with relevant imagery, coverage scenarios and testimonials from actual customers in those industries, making every visitor feel understood.

- Playful Yet Professional Tone: Bright colours, friendly illustrations and conversational copy create an approachable brand that makes business insurance feel less intimidating while maintaining credibility through clear information and transparent pricing.

- Social Proof Integration: Customer reviews with specific details about industries, claim experiences and satisfaction are woven throughout the site rather than buried on a testimonials page, building trust at every step of the customer journey.

- Online Self-Serve Process: The entire insurance purchase process – from quote to policy issuance – happens online without phone calls or paperwork, with coverage starting immediately, demonstrating Next’s commitment to making business insurance actually simple.

10. Policygenius

Website: https://www.policygenius.com/

Company Overview: Policygenius is a leading online insurance marketplace founded in 2014, helping consumers shop for and compare life, home, auto, disability and pet insurance from top-rated carriers. Rather than selling one company’s products, Policygenius licensed agents guide customers through comparing dozens of providers to find the best coverage at the right price.

Why Their Website Design is Top Tier:

- Marketplace Architecture Excellence: The site brilliantly balances showcasing multiple insurance carriers while maintaining a consistent Policygenius experience, with clear comparison tools that make evaluating dozens of options feel simple rather than overwhelming.

- Educational Content Strategy: Comprehensive guides, calculators and expert articles are woven throughout the site, positioning Policygenius as a trusted advisor rather than just a quote engine, with SEO-optimized content that drives massive organic traffic.

- Trust Indicators Everywhere: Financial strength ratings, carrier details, transparent advisor credentials and specific customer reviews are prominently displayed, addressing the inherent concern about buying insurance through a third-party marketplace rather than directly from carriers.

- Conversion-Optimized User Journey: Multiple entry points guide visitors toward getting quotes based on their specific insurance needs, with progressive disclosure that collects information gradually rather than presenting overwhelming forms, dramatically improving completion rates.

Key Takeaways for Your Insurance Website Design

After analyzing these outstanding insurance web design examples, several universal best practices emerge that any insurance company can apply:

First impressions happen in seconds. You have approximately 3 seconds to capture a visitor’s attention before they navigate to a competitor. Invest in modern design, professional photography/illustration and fast loading speeds to make those crucial seconds count.

Mobile optimization is non-negotiable. With the majority of insurance searches happening on mobile devices, your website must deliver flawless experiences on smartphones and tablets. Test all features – especially quote forms – extensively on various devices.

Make quotes frictionless. The easier you make it to get quotes, the more leads you’ll convert. Implement instant online quoting, prominently place quote CTAs throughout your site and offer multiple contact options including chat, phone and email.

Build trust through transparency. Hidden fees and complex jargon erode trust. Successful insurance websites explain coverage clearly, display pricing honestly and provide educational content that empowers informed decisions rather than confusing customers.

Use social proof strategically. Customer testimonials with specific details, financial strength ratings, press features and claim processing statistics strategically placed throughout your site dramatically increase conversion rates and help anxious visitors feel confident choosing you.

Showcase what makes you different. Generic “we offer great rates and service” messaging gets lost in the noise. Specify your unique value proposition, whether it’s technology, pricing model, target market or values, to help the right customers find you and feel understood.

To Sum Up

The best insurance websites of 2026 prove that insurance web design has evolved far beyond basic information delivery. These companies understand that exceptional website design is a competitive advantage – one that attracts new customers, builds immediate trust and supports sustainable business growth.

Whether you’re an independent agent, a specialty carrier, a digital-first insurtech or an established insurance company, your website should reflect the same level of innovation, transparency and customer focus that you bring to your policies and service. The insurance website design examples featured here set a high standard, but they also provide a clear roadmap for creating digital experiences that truly serve your customers’ needs while driving measurable business results.

In 2026, the insurance journey often begins with a Google search (or AI search). When potential customers land on your insurance website, make sure they find not just quotes but confidence, clarity and a compelling reason to choose your company. Your insurance website isn’t just about looking modern – it’s about converting visitors into policyholders and building a thriving business that grows year after year.

Looking for more insurance web design strategies? Check out our top 10 web design tips for insurance companies in 2026.

Thinking about outsourcing your insurance web design project? Get in touch with our team!