Web Design Agency for Insurance Companies

Creating Professional, Custom Website Designs for Insurance

Delivering modern, lead-generating website design services for insurance companies since 2018. Are you ready to become our next success story?

Whether you represent an insurance company, brokerage or carrier, Azuro Digital has you covered with our cutting-edge insurance web design services. Let's grow your digital presence!

Industry Research

We conduct research on your business, target market and competitors to ensure that your insurance website stands out from the crowd with the right strategy for design, content and SEO.

Marketing Strategy Review

We review your marketing channels and sales process to enable your website to support those lead generation sources in terms of the overall user journey, messaging and analytics.

SEO Research & Planning

We do an SEO audit of your existing site and establish benchmarks for future traffic expectations. We will perform comprehensive keyword research and optimize your content accordingly.

Conversion Strategy

Time to convert your website traffic into paying customers. This involves using the right calls-to-action, displaying impactful social proof to build credibility, and streamlining the user experience.

Content Outline & Editing

We will help you determine what pages to have, what sections to have on each page, and how the content should be laid out. We will also make edits to enhance the quality of your content.

Design & Development

When designing and developing your insurance website, we prioritize accessibility, security, speed, reliability, authenticity, SEO, conversion rates, and the end-to-end user experience.

Unlimited Revisions

We provide as many design concepts and revisions as needed. Creating a website is an intimate process and we believe in being flexible. We treat our insurance clients like partners.

Quality Assurance & Testing

We make sure that your website looks perfect across all devices, browsers and screen sizes. We also ensure that all functionality works correctly and that all SEO tasks have been implemented.

Launch & Maintenance

We launch your website and train your team on how to edit and manage the website yourselves. We're also always available to make any ongoing edits and additions on your behalf.

Superior Websites for Insurance

We work with all types of insurance providers – from life insurance to cyber insurance and everything in between. As an insurance company, your website visitors are looking for signs of trust, credibility and simplified information to easily understand what you offer and what the next steps are. At Azuro, we help you with all aspects of achieving that goal – from the design aesthetic and content quality to the user experience and SEO/GEO.

We're a Verified Leader in Web Accessibility for Insurance Companies

AccessibilityChecker.org has recognized Azuro Digital as a verified web agency for accessible websites. Accessibility laws like ADA and AODA are increasingly enforced. By partnering with Azuro, not only will you avoid fines, but you'll also attract a whole new audience to your site.

From Our Blog

FAQs

Your Questions, Answered

What are your top strategies for insurance web design?

In insurance web design, you must simplify complex products while building trust in an industry notorious for confusion and fine print. Here’s what drives quote requests and policy sales:

Implement instant quote tools as your centrepiece. The instant quote is your primary conversion point. Create sophisticated calculators providing accurate estimates within seconds for auto, home, renters or other products (in exchange for their email address). Make them genuinely instant – not “get a quote” forms that simply capture leads for callbacks. Use smart form logic showing or hiding questions based on previous answers. Include coverage education within the flow with tooltips explaining liability limits or deductible impacts. Offer side-by-side comparisons showing how coverage adjustments affect premiums. Save progress automatically. For complex products like life insurance where instant quotes aren’t feasible, explain why and offer expedited timelines: “Personalized quote within 24 hours.”

Create dedicated pages for every insurance product type. Auto, home, life, renters, umbrella, business – each needs a comprehensive page with product-specific information, coverage explanations, typical costs and relevant quote tools. Explain coverage types clearly: for auto, detail liability, collision and optional add-ons. Address common questions: “What’s not covered?” Include state-specific requirements. Use clear, jargon-free language throughout – insurance terminology confuses most consumers. These detailed product pages attract SEO traffic and educate prospects before purchase decisions.

Simplify claims filing with digital processes. Claims handling determines satisfaction and retention. Create prominent, easy-to-find claims centres accessible from every page. Design streamlined digital filing allowing 24/7 claims reporting without phone calls. Implement step-by-step processes with progress indicators. Allow photo uploads directly from mobile devices. Provide claim status tracking where policyholders monitor progress and see payment timelines.

Display transparent pricing and discount information. Be clear about what affects premiums: driving record, credit score, location, coverage limits. Prominently list all available discounts: multi-policy bundling, safe driver, good student, home security. Quantify discount impacts when possible: “Save up to 25% by bundling.” Create discount checklists or savings calculators.

Build educational content to make insurance understandable. Explain how insurance works, why coverage matters and how to evaluate adequate protection. Create glossaries defining terms in plain language. Develop comparison content: “Term vs. Whole Life Insurance Explained.”

When you combine instant quoting, product clarity, simplified claims and pricing transparency, you build trust that converts shoppers into policyholders in an industry where confusion typically reigns.

What is your web design process and philosophy?

As a results-driven web design agency, we focus on generating revenue for our insurance clients.

We believe that the purpose of web design is not only to create something beautiful, but to create something that will increase your volume of leads & sales.

To deliver a strong return on your investment, we prioritize industry research, search engine optimization, compelling copywriting, conversion rate optimization, and creating a user experience that drives engagement.

We consistently win design awards from platforms like DesignRush, WebAwards, CSS Design Awards and more, but we’re prouder of the bottom-line results that we achieve for our clients.

We’ve accumulated over 100 five-star reviews on platforms like Clutch and Google, and our clients love to talk about the measurable results that they’ve achieved with Azuro.

We treat our clients like partners every step of the way!

Which platforms do you use for web development?

We typically use WordPress to develop insurance websites. WordPress is by far the most popular website builder in the world – and for good reason. It’s flexible, fast, secure, open source and easy to use.

While we use WordPress in most cases, we also use Webflow for some projects.

All of our designs are custom-made, fully accessible and responsive across all devices and screen sizes. If you’re seeking a top-tier website that stands out from competitors, we’ve got you covered!

Do you only provide web design services for insurance companies?

While many of our web design clients are insurance companies, we also provide web design services for many other industries such as manufacturers, physicians, real estate developers and more. We deliver custom solutions that are catered to the unique needs of each client. We act as a true partner on all projects and form long-lasting relationships.

Do you perform ongoing A/B testing to maximize results?

Yes, we do this for many insurance clients. While we maximize your ROI as much as possible from the beginning, it’s always best to conduct ongoing A/B split testing upon the launch of a website. That way, we can test different versions of your website in order to collect data and make changes based on what actually performs best. We set up comprehensive analytics to measure traffic and conversions, allowing us to make smart decisions and maximize your insurance website’s results on an ongoing basis.

Insurance Web Design Project

Check Out Our Recent Work!

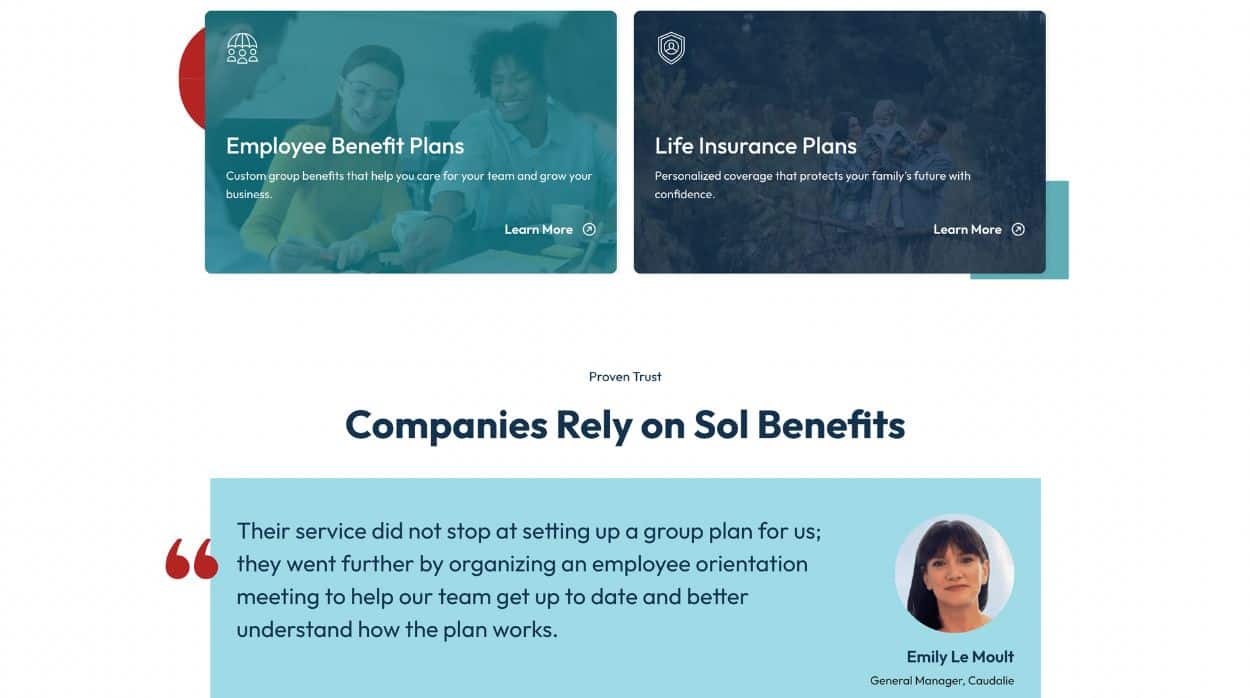

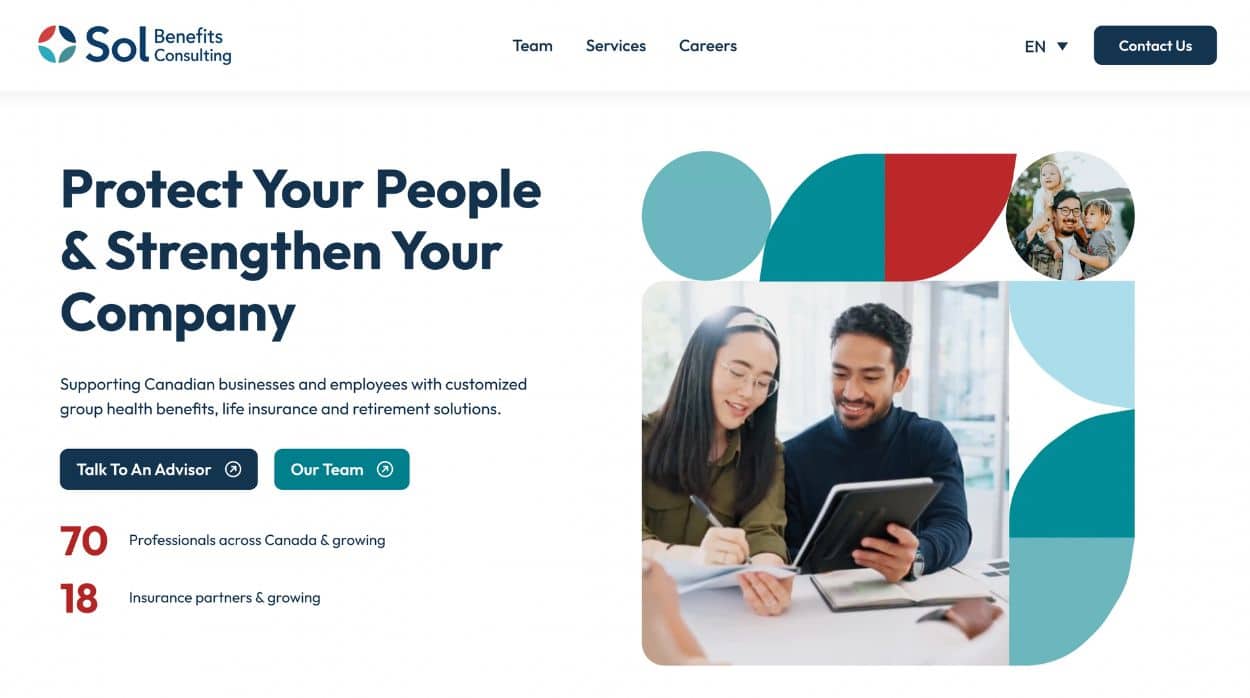

Sol Benefits Consulting

"Azuro Digital's professionalism, transparency, and attention to detail is a cut above the rest. Their team provided extremely good input for the strategy of our life insurance and health benefits website. I really appreciated working with them as it was clear that they treated this project with as much care and passion as we did, and took the time to understand what our vision needed to be. They guided us from start to finish and we are very happy with the result of the branding and the website."

Jeff Wang

Partner at Sol Benefits Consulting